2024 in review: what happened?

- In Blog

- 2024, Visitation, visitor attractions, year on year growth

- 5 min read

The past year has been marked by turbulence and transformation for the visitor attractions industry. While some destinations saw record breaking growth, others struggled with external challenges ranging from economic uncertainty to extreme weather events.

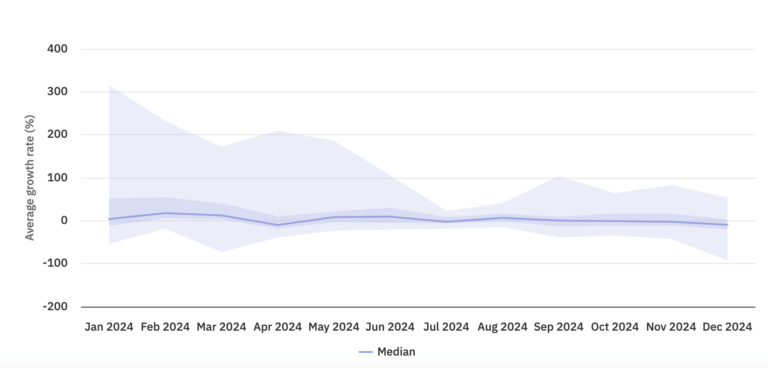

Globally, the median monthly year on year growth rate for visitor attractions with Dexibit ranged from a high of 18% in February to a low of -10% in April. Overall year on year growth was 5%, down from 30% the prior year.

Whilst other public and publicly owned visitor attractions (or those that otherwise publish their visitation publicly) are yet to report numbers for the full year, typically attractions with Dexibit pull significantly higher growth than the rest of the sector (in 2023, this was 19%). As seen in the earnings released by major theme parks, 2024 was a year of decline for many attractions.

Here’s a deep dive into what shaped the year in visitation and what it means for attractions moving forward. For more benchmarking data and to compare your attraction’s own performance, login to Dexibit.

🎢 The rollercoaster of visitation growth

Year on year growth rates in 2024 have been volatile, with the southern hemisphere experiencing stronger recovery while parts of the northern hemisphere faced declines. It was a year of extremes: notable attractions saw growth rates upwards of 90%, while others endured drastic declines in reverse.

🔹 January – March: A strong start to the year, particularly in the southern hemisphere where attractions benefited from peak summer visitation and a still continuing rebound in international travel and an earlier Spring Break and Easter.

🔹 April – June: A notable slowdown, with some destinations experiencing a decline in visitation due to shifting travel behaviors, economic pressures, and calendar driven factors. April 2024, for instance, had fewer weekend days compared to 2023, impacting weekend driven visitor attractions.

🔹 July – September: Stabilization in many markets, with summer tourism buoying numbers in the northern hemisphere and off peak trends shaping the southern hemisphere’s shoulder season.

🔹 October – December: A mixed bag, as some attractions benefited from holiday travel, while others, particularly in regions hit by economic downturns or extreme weather, saw steep drops. December 2024 also had a different distribution of weekend days compared to 2023, influencing visitor patterns and shifting revenue expectations for attractions dependent on weekend peaks especially with the holiday season build up.

🌍 The macro factors at play

1. Economic uncertainty and inflation

The global economy has been in flux, with persistent inflationary pressures or resulting reactive fiscal policy influencing discretionary spending. While some regions saw strong consumer confidence, others — especially in Europe and North America — faced cautious spending behavior. Attractions offering dynamic pricing and flexible ticketing were better positioned to adapt to shifting demand. Per caps continued to increase slightly, however are still out run by a rising cost to serve.

2. Weather and climate impacts

Extreme weather events had a profound effect on visitation this year.

🌀 Hurricanes and floods in parts of the U.S. and Asia led to attraction closures and disruptions in key travel seasons.

🔥 Heatwaves across Europe during the summer deterred outdoor visitation, while early winter storms impacted holiday tourism.

⛄ El Niño led to unpredictable seasonal tourism trends, affecting both ski resorts and coastal attractions.

3. Tourism and consumer trends

✈️ Shorter booking lead times: Visitors booked closer to their trip dates than ever before, continuing a post-pandemic trend of spontaneous travel.

😤 Rising visitor expectations: Visitor happiness experienced a slight dip in 2024 since the year prior. It had previously rallied after seeing a significant dip in 2022.

💻 The rise of digital planning: Mobile first booking and contactless experiences became standard visitor expectations. AI driven recommendations are on the rise – a channel difficult to control and measure.

🚀 What this means for 2025

As visitor attractions prepare for 2025, macroeconomic trends and major global events will play a key role in shaping visitation. Attractions must be ready to adapt to the following developments:

📈 Economic conditions: Continued inflationary pressures and potential interest rate adjustments will impact consumer spending. Attractions that offer flexible pricing models, membership incentives, and value-driven experiences will be better positioned to retain visitors.

🇺🇸 Major political events: The U.S. presidential inauguration in January will likely influence domestic and international tourism patterns, particularly in Washington, D.C. and surrounding regions in the lead up to the 250th anniversary the following year. Additionally, other elections across Canada, Europe and key markets may drive or deter travel depending on uncertainty.

🌍 Global tourism trends: As visa policies and international relations shift, expect changes in inbound tourism, particularly from China as its outbound travel market recovers further. The rise of digital nomad and long stay tourism will also shape destination appeal.

🌦️ Weather disruptions: With climate change leading to more extreme weather patterns, attractions should expect and prepare for unexpected closures or visitation dips due to hurricanes, wildfires and heatwaves which are becoming an annual occurence.

🎭 Cultural and sporting events: Major global events such as the 2025 World Expo in Osaka, the reopening of Notre-Dame de Paris and the once in 25 year Jubilee at the Vatican will drive significant tourism to host regions and potentially impact travel flows in other parts of the world. We will see if Oasis can match the Taylor Swift effect in star power with their first tour after 15 years. Attractions near key event locations should anticipate both opportunities and operational challenges related to crowd management and demand spikes.

🛠️ Agility is key: To navigate these uncertainties, attractions should focus on intelligent forecasting, real time insights and fostering an insight inspired data culture.

How has 2024 shaped your attraction’s visitation patterns? What trends are you anticipating in 2025? Share your experience with us!

Want to learn more about Dexibit?

Talk to one of our expert team about your vision to discover your data and AI strategy and see Dexibit in action.